California homeowners get to pass low property taxes to their kids. It’s proved highly profitable to an elite group

Many descendants of California homeowners enjoy a significant perk that keeps their property tax bill low. Part of that is thanks to Proposition 13, which has strictly limited property tax increases since 1978. But they also benefit from an additional tax break, enacted eight years later, that extended those advantages to inherited property — even inherited property that is used for rental income.

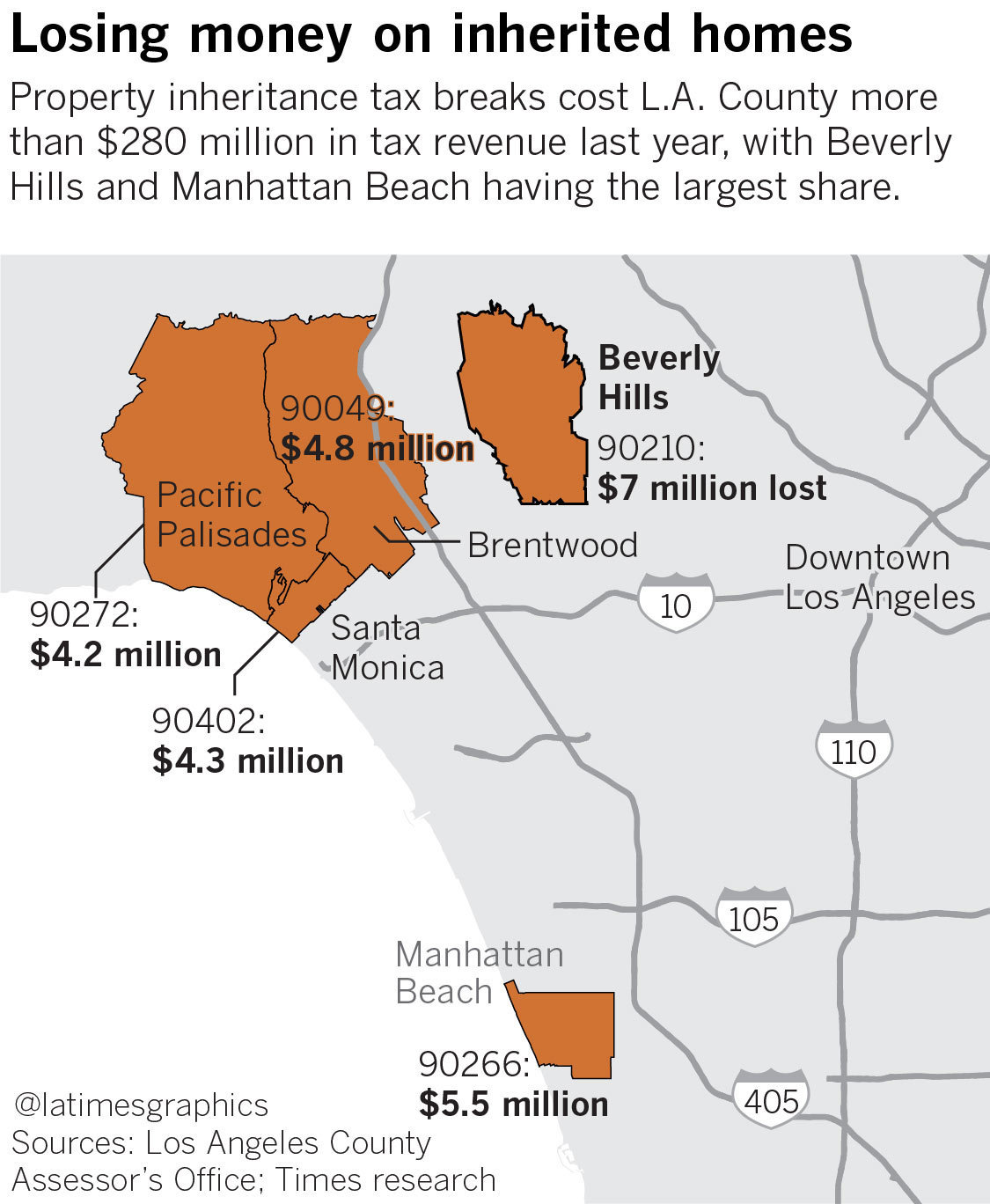

The inheritance tax break, The Times has found, has allowed hundreds of thousands — including celebrities, politicians, out-of-state professionals and some of California’s most prominent families — to avoid paying the higher taxes owed by newer homeowners. The tax break has deprived school districts, cities and counties of billions of dollars in revenue.